While the industry strives for simplicity in what touches the customer, the role of the front-line banker remains complex. Training alone is not sufficient to manage this complexity and extract maximum shareholder value. There now is a solution with ROIs that are truly staggering.

The real-time choices a front-line banker has to make of what product or solution to offer to whom and how to “connect” it to the customer’s needs is complex and requires training, no matter what systems on “next best product to offer” might do to aid. Beyond sales, there are policies and procedures that have to be followed in practically every action. There are scripts that have to be adhered to. There are behaviors that are trained on how to deal with different types of customers… and the list goes on.

The easiest way to appreciate the complexity of a front-line banker’s job is to look at the amount of training they have to go through. Whether it is in-person or long series of on-line courses and certifications, even the most junior front-line banker needs a fair amount of training before they can “fly solo”. Training needs are more complex in a branch environment than a call center where calls can be routed either based on what the customer (or prospect) has selected in the IVR (e.g., apply for a credit card), the number the customer called (e.g., the SME call center), or simply based on the customer having been identified.

In the call center, not only can skillset be compartmentalized, and calls routed to product specialists or more experienced agents depending on their characteristics, but conversations with customers can be monitored, analyzed, and the call center agents can (and do) receive constant coaching. This is not Big Brother watching but a perpetual coaching environment.

In the branch the reality is vastly different. While certain specialists may be available in the branch to support less experienced front-line bankers, the needs of customers and prospects are far broader and less predictable. Furthermore, it is more common for customers who have been unable to have their issues resolved by remote channels such as the call center, to walk into a branch as a self-selected escalation channel. The same is true for product sales.

The branch staff have to rely on their training and – unlike their call center brethren – don’t have the benefit of personalized coaching. Why? Because their face-to-face interactions with customers and prospects are not observed, not reviewed, not scored. Any weaknesses are not identified nor coached.

One might ask “if training is good, why do we need follow-on coaching?”

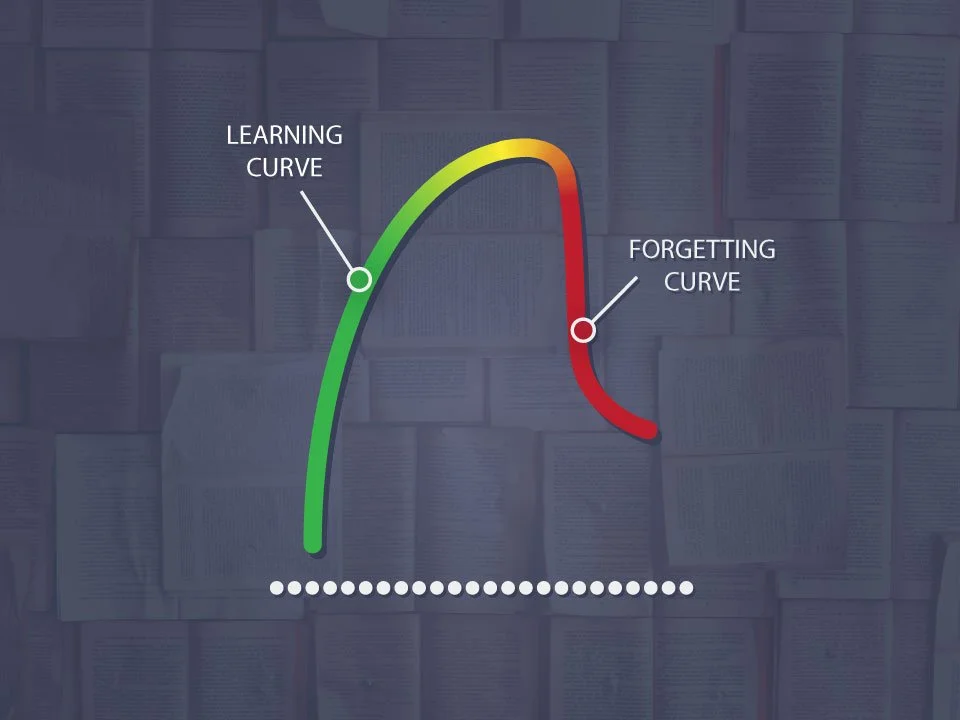

The answer is the “Forgetting Curve”.

This is human nature. As the ancient Greeks said, “repetition is the mother of knowledge”. If you do not repeat knowledge you tend to forget it. You tend to improvise and do what seems “natural” instead of what you were trained to do. You tend to forget procedures. You tend to be influenced by practices of colleagues who might have decided to short-cut or improvise relative to what they were trained to do.

However, repeating the entire curriculum would be heavily disruptive to bank operations and would raise training costs by factors not percentages. Furthermore, such a blanket re-training approach would be frustrating for staff to be re-trained not only on what they might have forgotten – a valuable activity – but also on what they remember – a frustrating experience.

So how does a bank combat the “Forgetting Curve” of its branch-level front-line bankers? These bankers are arguably the most important customer-facing force since they are – for most banks – the prime revenue generators, the face of the bank to new customers, the peacemakers who resolve customer complaints.

The answer is a new technology: in-branch recording. Simply put, the use of special microphones and special recording software at the platform desk that can capture and analyze the conversations between a banker and a customer or prospect. This technology emulates the environment that call center agents – and their customers – have been accustomed to for decades. There are specific technical obstacles that had to be overcome:

Unlike in a call center, there is ambient sound in a busy branch. This includes conversations from adjacent platform desks, the sound of customers waiting to be served, street sounds, the echoing acoustics in modern branches that have glass and other sound reflective surfaces (note that call centers tend to be covered in sound-absorbing surfaces, including the agent cubicles).

The separation of the voice of the customer from the voice of the agent is very simple in a phone conversation when each person has their own dedicated microphone and therefore their own dedicated audio track. This is not the case in a face-to-face environment when the customer and the agent are in close proximity. A microphone placed between them would pick both voices and not be able to separate one from another.

A call has a beginning and an end. A call center recording system knows when one customer conversation ends and when the next one starts. An equivalent recording system on a platform desk would not automatically know that one customer stood up and left and the next sat down (or walked up to or walked away from a universal banker pod).

In the call center, customers tend to identify and authenticate themselves in the IVR ahead of call. If not, call center agents tend to do it for them. In both cases, and because each call center recording is discrete, metadata is easily and automatically appended. The common practice of wrap codes in the call center further adds to the metadata. In the more fluid branch environment, there is no equivalent.

All these obstacles have now been overcome with new technology advances. They allow branch staff to have the same personalized custom coaching that call center agents enjoy. They allow trainers and even branch managers to get personalized feedback on each banker and direct their re-training and coaching efforts. It also allows for insights into commonly forgotten or even misunderstood curriculum elements and therefore an ability to sharpen the initial training.

Furthermore, combating the “Forgetting Curve” has additional shareholder value-adding benefits.

A better trained agent will:

Be more satisfied because he will more likely succeed

Drive higher customer NPS since he will be able to better serve customers

Increase sales, cross-sales, and overall revenue

Reduce expenses because he will be more efficient and less likely to cause re-work in the branch or the back office

Reduce operating risk

Increase retention by being better trained to resolve the issues of dissatisfied customers

To capture these benefits, the right business processes need to be built around this new technology. Our experience at Delos Advisors is that these business processes can be built rapidly, in a matter of weeks, not months or years.

We have already implemented this technology and designed custom business processes to extract maximum benefit from it. ROIs can easily be calculated. The results have been staggering.