Digital transformation has enabled offering better customer service at a lower cost. Channels with high labor intensity like contact centers have become primary targets for cost cutting. Is that universally smart?

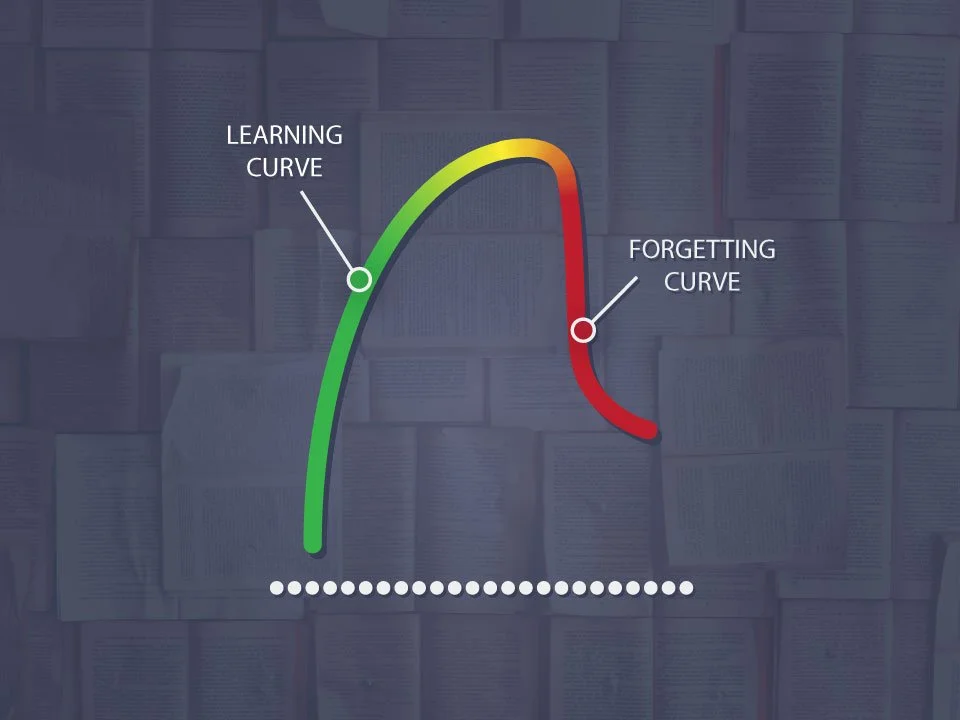

Don't Forget the Forgetting Curve

COVID-19: Stay Focused on the Darkness but Point to the Light

We are in the midst of a risk that none of us prepared for or truly anticipated; a “novel” risk. Times like these call for distinctive leadership: simple, clear, to the point, back-to-fundamentals leadership. In this white paper we describe seven situation assessments for banks (implications & suggested actions) and one leadership approach.

Why Is CX in Bank Branches Still Relevant

In recent years there has been increased emphasis on improving customer experience on mobile and online channels. Branch initiatives have focused on cost cutting: closures/consolidations, forcing customer migration to digital, reducing headcount. Our consumer research has repeatedly shown that this is a false approach.

“It’s the deposits, stupid!” How to prevent your bank from starring in a sequel of 2008

In 2008 we saw many banks that heretofore appeared to be investor darlings, implode in a tsunami of defaults and skyrocketing LLPs that wiped out profitability. Why? Deposit weakness. Our analytics proved that banks that scored low on our Deposit Strength Index (DSI) were more likely to fail in the previous cycle.

Does Customer Experience Really Drive Shareholder Value?

Six Projects to Close the Year with Powerful Quick Wins

As we discuss with clients their priorities for next year engagements, many ask for quick win ideas to deploy remaining rolling year budgets against. These are six of the most popular ideas for “Q4 specials” we have been sharing, such as Monitoring Face-to-Face Customer Interactions and Developing a Cross-Sell Strategy.

Why Is Profitability Measurement at a Granular Level So Important in Banking

Boards of Directors, senior executives, and shareholders correctly obsess about profitability. But ROA, ROE, and related profitability metrics tend to disappear from performance reports as we move down the organization. Rarely does one see true profitability, let alone ROA or ROE, reported at the branch, RM, or even Business Unit levels. Why is this a problem?

Six Analytics Platforms Every Retail Bank Must Have

Many often talk about the need for analytics in banking. Recent trends are on deposit pricing and there is an increased focus on operational risk. But which are the six core/foundation “must have” building blocks on which management can build strategies and tactics to increase shareholder value: ROE and revenue growth? .

7 Questions To Break The Cross-Sell Barrier

There is a painful fact in banking: across its base, a bank has less than 30% of its customers’ share of wallet. The rest is with competitors or, even worse, is an unmet need. Banks approach this problem from their vantage point and bombard customers with offers to gain the share of the wallet they do not have. Yet these efforts typically fail to understand human choices driven by psychology, logic, or just habit.

Are You Service Aware? C-SAT: “The Last 100 Defectors Test”

You may pride yourself of being aware of every financial metric and deeply understanding how a movement by a few basis points affects shareholder value. But can you answer a more meaningful question: "Do you know why each of the last 100 customers that defected from your bank and moved their business to another competitor did so?"

Is Managing to Metrics Dead After the Wells Fargo Fine?

Why Worry About Worry Management?

Customers encounter multiple worries when interacting with financial institutions. These worries are a major but unrecognized root cause of customer dissatisfaction and market share loss. Furthermore, because worrying is often a feeling that exists in the background, customers do not articulate it in their complaints or voice it when asked general open-ended questions about their experience.