Digital transformation has enabled offering better customer service at a lower cost. Channels with high labor intensity like contact centers have become primary targets for cost cutting. Is that universally smart?

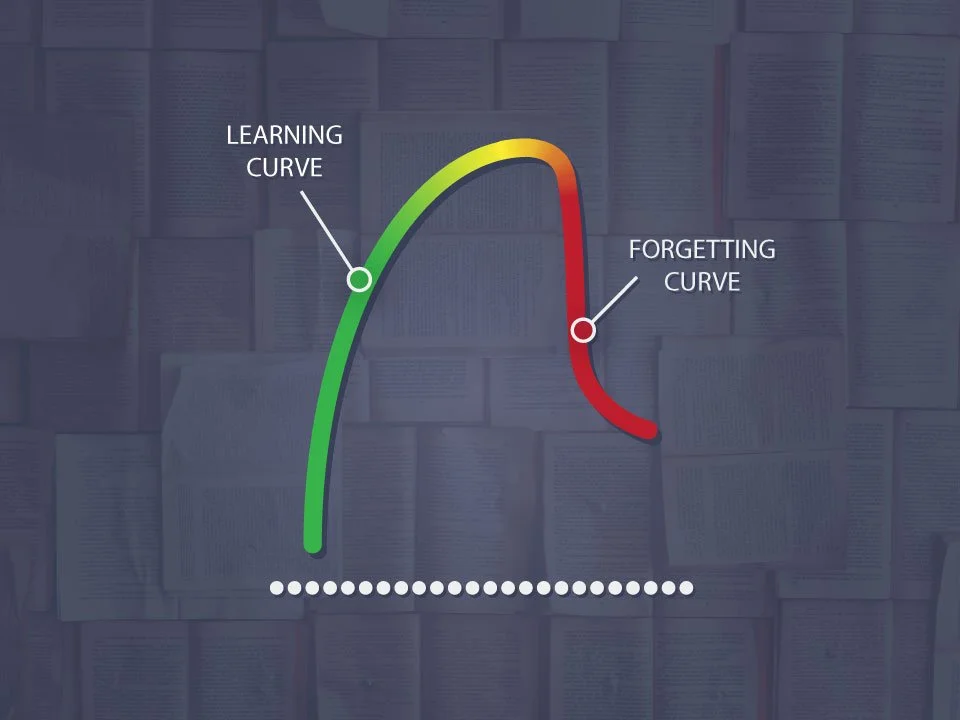

While the industry strives for simplicity in what touches the customer, the role of the front-line banker remains complex. Training alone is not sufficient to manage this complexity and extract maximum shareholder value. There now is a solution with ROIs that are truly staggering.

We are in the midst of a risk that none of us prepared for or truly anticipated; a “novel” risk. Times like these call for distinctive leadership: simple, clear, to the point, back-to-fundamentals leadership. In this white paper we describe seven situation assessments for banks (implications & suggested actions) and one leadership approach.

In recent years there has been increased emphasis on improving customer experience on mobile and online channels. Branch initiatives have focused on cost cutting: closures/consolidations, forcing customer migration to digital, reducing headcount. Our consumer research has repeatedly shown that this is a false approach.

In 2008 we saw many banks that heretofore appeared to be investor darlings, implode in a tsunami of defaults and skyrocketing LLPs that wiped out profitability. Why? Deposit weakness. Our analytics proved that banks that scored low on our Deposit Strength Index (DSI) were more likely to fail in the previous cycle.

Bank customers often complain about their service experience. Bankers try to improve their customers’ experience, but success is elusive. For the few banks that achieve service excellence, there is a treasure at the end of the rainbow: higher shareholder value. Can we quantitatively prove this?